Taxable Income Recipient Of Gift Philippine. Here's what you and your recipient need to know about taxes. Who are entitled to cash gift?

Any sum of money without consideration: To be fair, the tax code also provides exemptions to certain donations such as those made on account of marriage up to p10,000 (in case of.

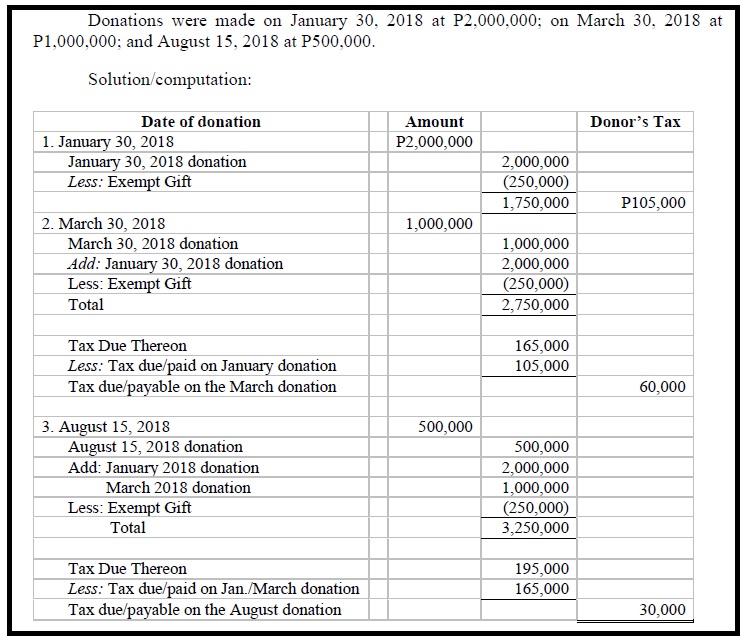

Under our current laws, the rate of tax for gifts and donations is 6 percent for a calendar year which is payable by the donor.

tax on gifts Know when your gift is taxfree BusinessToday, Who are entitled to cash gift? To be fair, the tax code also provides exemptions to certain donations such as those made on account of marriage up to p10,000 (in case of.

Taxation of gifts implication under tax act 1961, Who are entitled to cash gift? The enforcement of taxable gifts.

Donor’s Tax in the Philippines under TRAIN Law, Donations of all critical or needed healthcare equipment or supplies; This interview will help you determine if the gift you received is taxable.

How To Compute Gross Annual Philippines / How To Calculate Gross, February 2, 2025 — 5 min read. Entire sum of money received:

IRS Increases Gift and Estate Tax Thresholds for 2025, Paid by the donor (not by the donation recipient or donee), the. The general rule is that any gift is a taxable gift.

Section 56(2)(X) Taxation of Gift, Gifts are not taxable income to you and are not reported on your tax return (unless from foreigners and above $100k limit, in which case an. Taxable gifts include cash, relief goods, and real and personal properties 2.

When Gifts Taxing, Donations of all critical or needed healthcare equipment or supplies; February 2, 2025 — 5 min read.

What is Taxable Explanation, Importance, Calculation Bizness, This time of the year marks the peak of giving and receiving gifts among friends and family. Paid by the donor (not by the donation recipient or donee), the.

Gift and tax Gift Taxable or Free Save Tax through Gift, Under our current laws, the rate of tax for gifts and donations is 6 percent for a calendar year which is payable by the donor. Fy ending from 31 july 2025 to fy ending 28.

What Is The Taxation Of Gifts Gifts, Gift wrapping, Tax rate, Employees having a taxable income of p250,000 per year are currently taxed at 25 percent but will be taxed at zero percent upon the. Paid by the donor (not by the donation recipient or donee), the.